cumulative preferred stockholders have the right to receive

Preferred stock shareholders already have rights to dividends before common stock shareholders but cumulative preferred shares contain the provision that should a company fail to pay out dividends at any time at the stated rate then the issuer will have to make up for it as time goes on. In the case of a missed payment the holders from the cumulative Preferred Stock receive all the payments of dividends in the arrears prior to the shareholders getting a payment.

The cumulative feature of preferred stock may not give the preferred stockholders the right to receive current-year dividends and unpaid prior-year dividends before common stockholders receive any dividends.

. Preferred stockholders receive dividends in arrears only if the shares are cumulative. There is no guarantee they will receive dividends. Must receive more dividends per share than the common stockholders.

Company Cumulative Preferred Stock. Preferred shareholders only are entitled to dividends when they are declared. As referenced above cumulative preferred stock is a type of preferred stock.

Related

- floor to ceiling kitchen cabinets howdens

- how to take care of black man beard

- ways to fix a deviated septum without surgery

- where to buy compressed air singapore

- hard to kill movie 2021

- how to write a sonnet analysis

- how to use tea bag for tooth infection

- match gift card where to buy

- how to tone hair without toner

- what flowers are native to new york

Cumulative preferred stock dividends that have not been paid in prior years are said to be____. For this reason a definition of non-cumulative preferred stock solely in terms of the shareholders rights when there are no earnings is scarcely an adequate one. If any dividend payments have been missed in the past the dividends must be paid to cumulative preferred shareholders prior to any other shareholder.

Preferred stocks typically have fixed dividend payments based on the stocks par value. Normally the common stockholders have to be patient until all the dividends are. Once all cumulative shareholders receive.

Cumulative preferred stock i s preferred stock for which the right to receive a from ACCOUNTING 220 at University of Maryland University College. The cumulative preferred stock shareholders must be paid the 900 in arrears in addition to the current dividend of 600. A cumulative preferred stock is a type of preferred stock wherein the stockholders are entitled to receive cumulative dividends if any dividend payment is missed in past.

When a corporation is not able to pay dividends for a particular year they get accrued. Logically the term non-cumulative implies a dividend which is not cumulative and in fact various issues avoid the use of. Cumulative preferred stockholders have the right to receive dividends in arrears when dividends are subsequently declared.

This category of shareholders is entitled to dividends for a particular year regardless of the fact that the company has declared dividends for the particular year or not. Have the right to receive dividends only in the years the board of directors declares dividends. Priority preferred Preemptive preferred Dividends are not paid 10 preferred stockholders.

If the preferred stock is cumulative preferred shareholders have the right to receive all back dividends that were not paid before any cash dividends may be paid to common stockholders. Cumulative preferred stocks right to receive dividends is forfeited in any year that dividends are not declared. In the whole non-cumulative preferred stock controversy.

Cumulative Preferred Stocks are considered one of the most popular equity financing sources for the company. Cumulative preferred stock sometimes called cumulative dividend preferred shares is a type of preferred stock that provides assurance for dividend payments. This type of preferred stockis oled Cumulative preferred.

Corporations issue preferred stock because the equity market may not be receptive to a new issue of its common stock or lenders may believe the company needs an equity infusion before it becomes creditworthy. Cumulative preferred stock shareholders have the right to receive a dividend whether or not one is declared. A preferred stock investment might be the answer to your needs.

The participating preferred shareholders would receive 10 million but also would be entitled to 20 of the remaining proceeds 10 million in this case 20 x 60 million -. A non-cumulative preferred. Cumulative preferred stock is preferred stock for which the right to receive a basic dividend accumulates if the dividend is not paid.

2 days agoA cumulative preferred stock is a type of preferred stock that requires the company to make up for any missed dividend payments which accrue to preferred stockholders. The shares of cumulative preferred stock of the Company par value 01 per share the Cumulative Preferred Stock. This means that cumulative preferred shareholders take greater priority.

However noncumulative stocks undeclared dividends accumulate each year until paid. One of these rights may be the right to cumulative dividends. If this right hasnt been upheld you may have options -.

The dividends will keep getting accrued till they are paid. Cumulative preferred stock contains a provision requiring that any missed dividend payments be paid out to. They have the following salient features.

C must receive dividends every year. Preferred stockholders have the right to receive dividends to strears those not paid in prior years promised prior to common stock dividends being paid. Have the right to receive dividends only if there are enough dividends to pay the common stockholders too.

Cumulative preferred stockholders have the right to receive _____ before common stockholders are paid any dividends. Cumulative and Non-Cumulative Preferred Stock. Dividends are paid out regularly such as quarterly or annually.

To ensure investors of the.

What Is Preferred Stock Definition Pros Cons Thestreet

What Is Preferred Stock Is It Right For My Portfolio Nerdwallet

Arrearages Meaning Example Uses And More In 2022 Accounting And Finance Financial Management Meant To Be

Preferred Stocks Explained Seeking Alpha

Chapter 7 Stock Valuation Problems

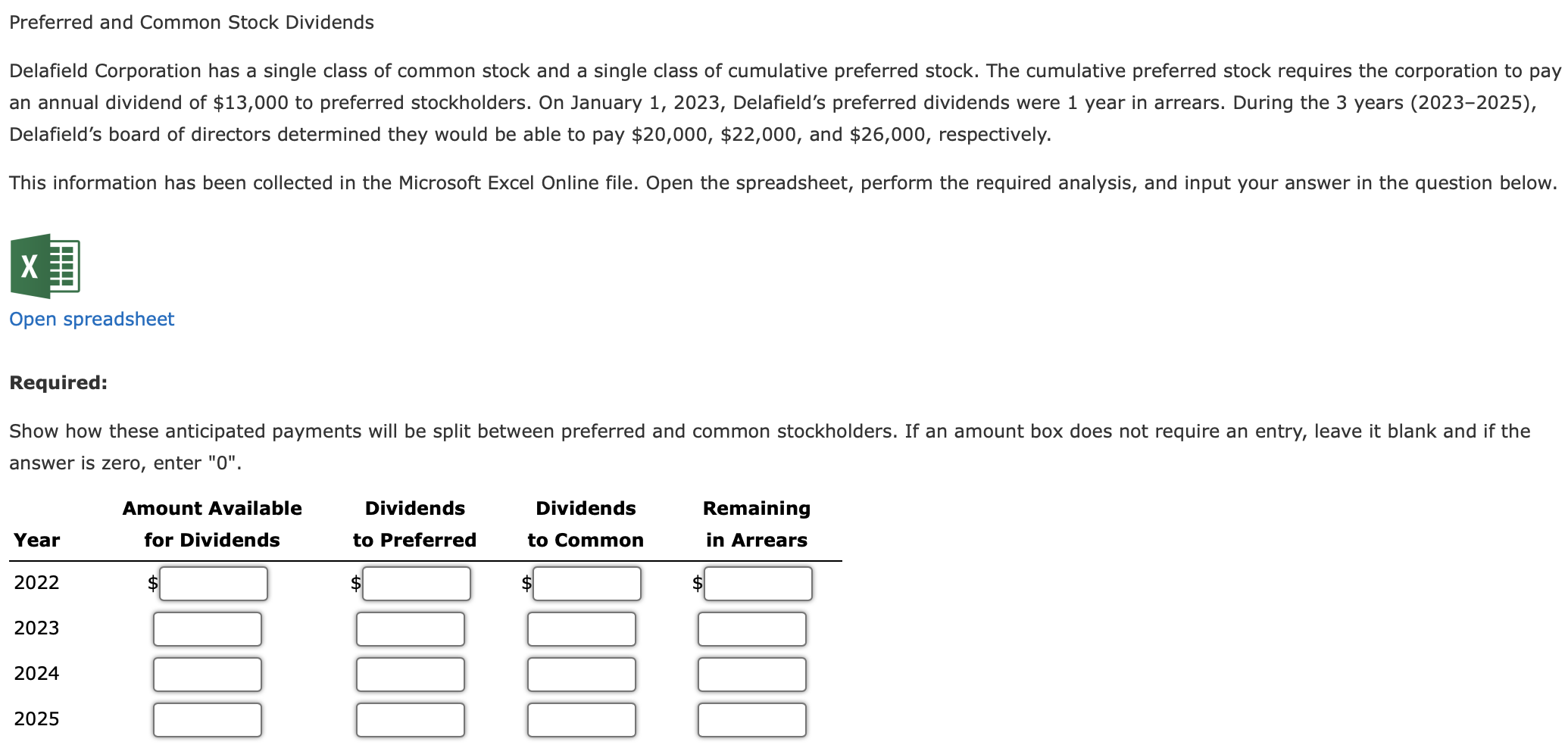

Solved Preferred And Common Stock Dividends Delafield Chegg Com

Common Stock Vs Preferred Stock A Guide Equitynet

Which Of The Following Typically Applies To Common Stock But Not To Preferred Stock In 2022 Common Stock Preferred Stock How To Apply

I Don T Understand Preferred Dividends Now What

What Is A Preferred Stock And How Does It Work Ramseysolutions Com

What Is Cumulative Preferred Stock Abstractops

Preferred Stock Explained 6 Types Of Preferred Stock 2022 Masterclass

Common And Preferred Stock Chapter 13 Pdf Preferred Stock Treasury Stock

Participating Preferred Stock Definition

What Is Preferred Stock Definition Advantages Drawbacks

Acc102 Chap11 Publisher Power Point